non resident tax malaysia

24 in excess of RM 600000. Malaysia Residents Income Tax Tables in 2022.

Individual Income Tax In Malaysia For Expatriates

Non-resident company tax rates.

. 26 Year Assessment 2010 - 2014 25 With Effect From Year Assessment 2015 28. Based on the Income Tax Act 1967 a non-resident of Malaysia will be liable to payment of withholding tax on interest income if he derives interest rates from loans in Malaysia. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Rate Business trade or profession Employment Dividends Rents. Here I will share 4 things Yamae needs to know about withholding tax on interest income if Mochiko Co. Resident company that does not control directly or indirectly another company that has paid-up capital of more than RM 25 million.

Residents and non-residents in Malaysia are taxed on employment income accruing in or derived from Malaysia. Payer refers to an individualbody other than individual carrying on a business in Malaysia. Payment for services rendered in Malaysia in connection with use of property or installation or operation of any plant machinery or other apparatus purchased from a non-resident person.

From 5000 to 20000. The current CIT rates are provided in the following table. For 2022 tax year.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Taxable Income MYR Tax Rate. Resident means resident in Malaysia for the basis year for a year of assessment YA by virtue of section 8 and subsection 61 3 of the ITA.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Another advantage of the resident status is that deductions from income are available while non-residents cannot use those to reduce their taxable income. Non-resident company tax rates.

Introduction Individual Income Tax. Residence status affects the amount of tax paid. Corporate - Taxes on corporate income.

NON RESIDENT BRANCH TINGKAT 3 6-9 BLOK 8 KOMPLEKS BANGUNAN KERAJAAN JALAN TUANKU ABDUL HALIM. The 90 Days Rule. Tax rates range from 0 to 30.

Ltd a foreign company earns interest income from its subsidiary. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Fees for technical or management services performed in Malaysia.

Non-residents pay a flat 28 on taxable income so it is advantageous for your employee to qualify as a resident. Income tax in Malaysia is territorial in scope and based on the principle source regardless of the tax residency of the individual in Malaysia. Someone who hasnt spend 182 days in a year in Malaysia.

The 90 Days Rule. Income derived in Malaysia by a non-resident public entertainer is subject to a final withholding tax at a rate of 15. Fees for technical or management services performed in Malaysia.

17 on the first RM 600000. The differences you must know in the Tax Treatments between a Resident and Non-Resident Company. Type of company.

Advance Pricing Arrangement. Last reviewed - 13 June 2022. Under Section 7 1 c of ITA 1967 if a person who stays in Malaysia for 90 days or more and has been either a resident or be in Malaysia for 90 days or more in 3 out of 4 immediate preceding years he qualifies as a tax resident in Malaysia for that year.

13 rows Personal income tax rates. Non-Resident Company Tax Rates. The source of employment income is the.

Tax residents pay progressive income tax rates of 1-28 based on income level. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia. Payment for services rendered in Malaysia in connection with use of property or installation or operation of any plant machinery or other apparatus purchased from a non-resident person.

Individual Life Cycle. Overseas invstment in Malaysia for example may mean reduced. Non-Resident means other than a resident in Malaysia by virtue of section 8 and subsection 61 3 of.

Be aware that if within the evaluated 182 days or less period that you are trying to re-qualify to resident tax status you are allowed 14 days out of Malaysia for social visits only. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors employees. A non-resident tax payer.

The following rates are applicable to. Chargeable income MYR CIT rate for year of assessment 20212022. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million. You are non-resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality.

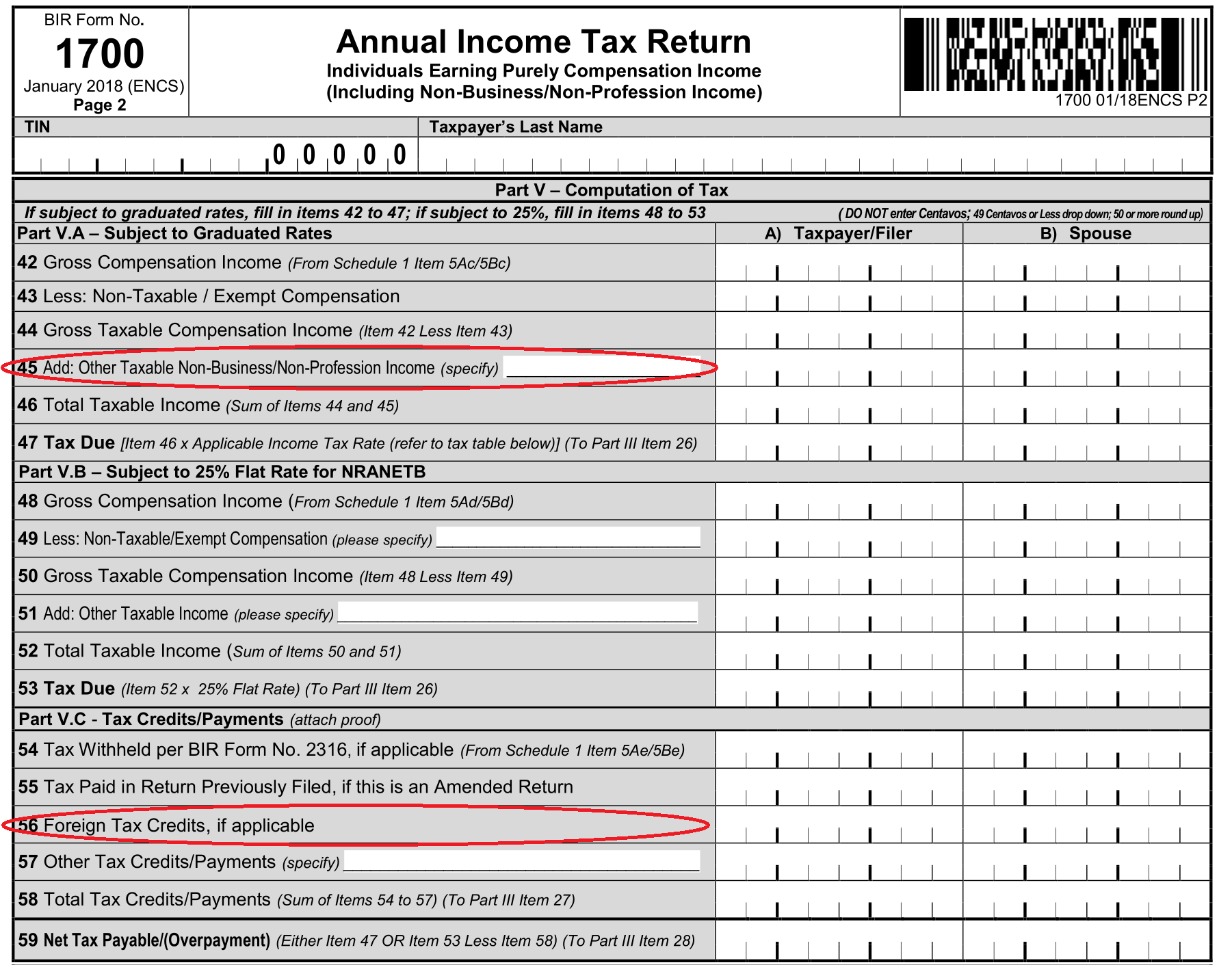

More Questions On Philippine Taxation Of Foreign Capital Gains And Dividends Ambitious Pawn

What Is Difference Between Nri And Nre Accounts In India

The Importance Of Non Tax Revenue In Some Countries Revenue Streams Download Table

Is Aadhaar Card Mandatory For Nri Cards Finance City Office

What Is Non Tax Revenue The Financial Express

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Tax Guide For Expats In Malaysia Expatgo

Pin On Doing Business In Singapore

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Healy Consultants Favourite Offshore Jurisdictions 2015 Offshore Business Infographic Infographic

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Pin On Oh Design X Client Branding

What You Need To Know About Payroll In Malaysia

U S Estate Tax For Canadians Manulife Investment Management

What Is Difference Between Nri And Nre Accounts In India

Pros And Cons Of Starting A Business In Malaysia S F Group Malaysia Starting A Business Business Visa

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Countries With Zero Foreign Income Tax Youtube

The Importance Of Non Tax Revenue In Some Countries Revenue Streams Download Table

No comments for "non resident tax malaysia"

Post a Comment